The gig economy is alive and well. In fact, this modern online phenomenon has only…

The Rise of the NFT and What it Means for Art in Advertising

NFTs—or non-fungible tokens—aren’t a new phenomenon. They’ve been around since 2014, but a recent slew of high-end sales and a unique Taco Bell brand campaign made NFT art and collectibles explode into mainstream consciousness. Simply put, NFTs are digital tokens that act like deeds to assets. While physical objects can technically be represented by an NFT or “tokenized,” the tokens are largely being “minted” to represent digital objects. Anything from internet memes and video clips to animated stickers and tweets can be turned into an NFT and sold. Sales occur through dedicated NFT marketplaces like Opensea, Rarible, and Foundation.

While confusion abounds around this nascent form of trading, NFTs provide a way for digital artists—whose work is often dismissed by art galleries—to monetize their art. With NFT platforms, content creators can circumvent the gallery middleman by selling directly to art collectors on the internet. If you’re skeptical about how much anyone would pay for ownership of something that only exists in the digital realm, think again. On March 11, 2021, digital artist Beeple sold NFT artwork through Christie’s Auction House for a staggering $69 million.

Wait, What Are NFTs?

An NFT—or non-fungible token— is a unique digital asset. The “non-fungible” part means it can’t be traded for another of the same kind or value. As an example, physical currency is fungible. You can trade one dollar bill for another and have the same value in your hand—it’s an equal trade. You cannot, however, trade an original van Gogh painting for an original Monet painting and end up with the same asset. These artworks are completely unique and are therefore non-fungible. They inherently hold different values and meanings depending on who you are and how much you are willing to pay for ownership of the piece in question. Digital assets in the form of NFTs are no different. In fact, the phenomenon has been dubbed a new form of art collection for a new breed of art collectors.

Much of the confusion surrounding non-fungible tokens stems from the fact that the digital content that’s turned into an NFT—and sold for millions of real dollars—can often still be found or viewed on the internet for free. As an example, the “Disaster Girl” meme was turned into an NFT and sold for $500,000. Anyone can Google the same meme and download it to their phone or laptop at no cost, so why would someone pay hundreds of thousands of dollars to own it? It all comes down to bragging rights, really—which isn’t all that different from traditional art collection.

While anyone can look at, download, and share the Disaster Girl meme, only one person can say they technically own it. There’s also the possibility that a digital asset will resell at a higher cost, making NFT collection a new type of investment, albeit a risky one. The good news for digital artists is that they can collect resale royalties each time their artwork changes hands. NFTs contain information within their metadata, like ownership history and artist signatures. Proof of NFT ownership exists as a transaction recorded—for the most part—on the Ethereum blockchain, a community-run type of database that powers the cryptocurrency ether (ETH).

Leveraging NFTs in Creative Strategy

Celebrities and public figures have hopped on the NFT train, helping fuel its recent hype. Twitter CEO Jack Dorsey turned his first-ever tweet into an NFT and sold it for nearly $3 million. Musicians like Snoop Dogg, Eminem and Grimes have turned video clips, digital comics and songs into NFTs and sold them for exorbitant amounts of money. Where celebrities see a new way to connect with their fans, forward-thinking brands are seeing a new opportunity to boost brand awareness and engage with their audiences.

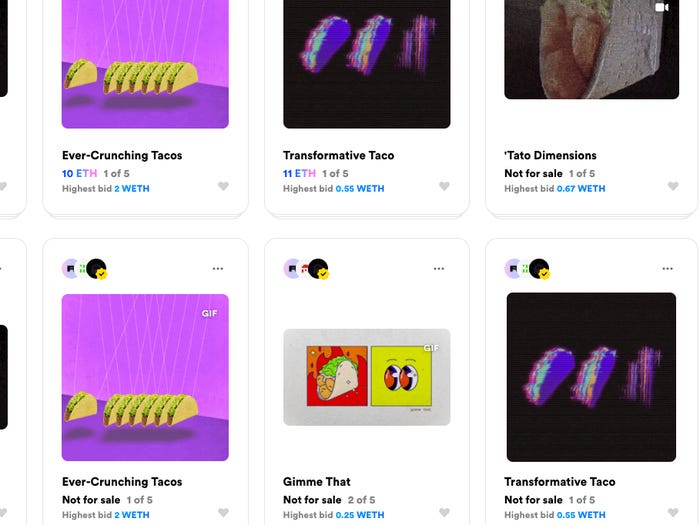

Taco Bell released a series of NFTs to celebrate the return of potatoes to its menu. The fast-food chain created five menu-themed pieces, selling five copies of each in its first-ever NFT collection. A total of 25 NFTs sold out in under 30 minutes, while some later resold for thousands of dollars. Proceeds from the sales are to be donated to the brand’s charitable branch, the Taco Bell Foundation.

In 2019, Nike patented Cryptokicks, a system that can utilize blockchain technology to link a digital shoe to a physical purchase. Within this system, consumers can store their digital kicks in a digital locker. When the sneakers are sold to someone else, ownership of shoes can be transferred by trading physical shoes and/or trading the digital version. As far as consumer engagement goes, the patent includes plans to let owners of Cryptokicks intermingle or “breed” one digital shoe with another, creating “shoe offspring” that can then be produced as a physical pair of sneakers.

NFTs in Digital Advertising

While the world waits to see if the NFT bubble will grow or burst, new forms of advertising seem gravid with potential. Though concerns have been aired about the energy it takes to power blockchain technology and its subsequent impact on the environment, developers all over the world are hard at work on sustainable solutions. Whether or not NFTs become an integral part of brand strategy, their versatility opens up endless ways for brands to tell their stories, create user engagement initiatives and collaborate with artists of all kinds.